A-C from the Main Menu

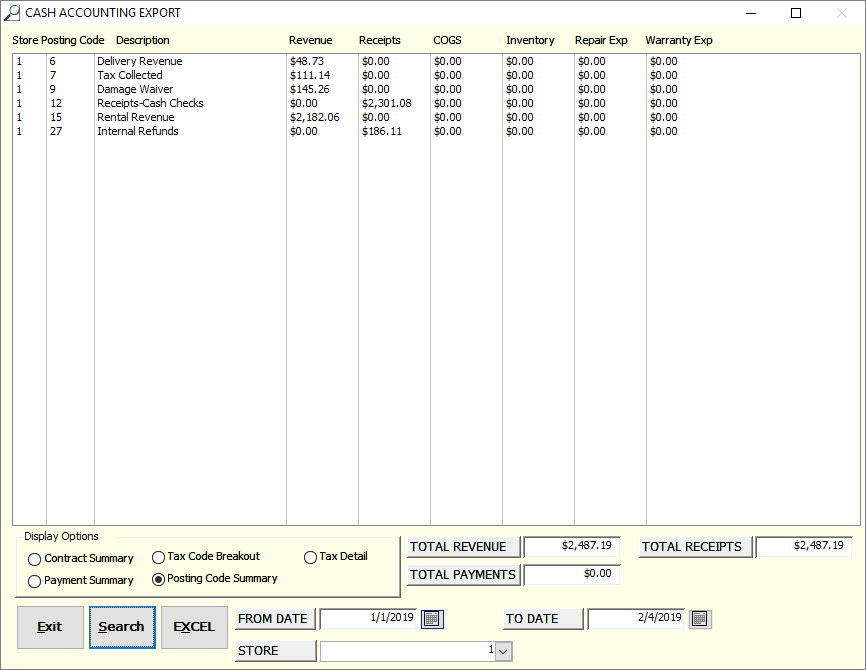

For customers who wish to view their financial activity on a cash basis, the Cash Accounting function (A-C from the main menu) will show the following information for any date range selected

Setup

Set up a posting code or use an existing posting code to populate the Unapplied Misc Pay Income field in the posting code tab of the store manager file. This field allows you to decide where you want to temporarily store unapplied payments on account.

Worth Noting

•This is the only screen in FocalPoint that recognizes revenue based on money received. All other reports in FocalPoint recognize revenue when an order is closed, regardless of whether the order was paid when it was closed or not.

•If you un-apply payments to invoices and re-apply the payments to other invoices, FocalPoint will not adjust revenue based on the new invoice (6-5-7, 6-5-8 and 6-5-9 from the main menu). You may want to make this functionality unavailable using security settings.

•To close an order / reservation that was cancelled, leave all line items on the order with dollar amounts, refund all payments, and void the orders

•This information does not export to third party accounting software. Use the "Posting Code Summary" to enter your journal entry into your accounting software.

To use this screen:

1.Set the date range and store as needed

2.Select one of the 5 options on the screen (described below)

3.Click on Search to refresh screen after choosing an option

4.Click on Excel to export to a spreadsheet for reporting or saving.

Contact Summary

This screen will list all orders for a day or date range. It will show the payment amount, the order total, the income amount and the tax amount. At the bottom of this screen you will see the total income, total tax and total payments. Under normal circumstances, the tax amount plus the income amount will add up to the payment amount. The “order total” is simply there for your reference, as are the other fields on this screen.

Payment Summary

This screen is a simple list of payment for the day or date range, with a total at the bottom of all of the payments.

Tax Code Breakout

This screen will show one-line per tax code, showing taxable, exempt, non taxable, and all 6 breakouts in the tax code setup.

Posting Code Summary

This screen is a breakout of all of your revenue, receipts and tax collected for a day or date range.

Tax Detail

Allows you to see details of the tax code breakout.