Tax Codes

6-9-5 from the main menu

Objective:

Set up a tax code record for every different tax district that you collect taxes for.

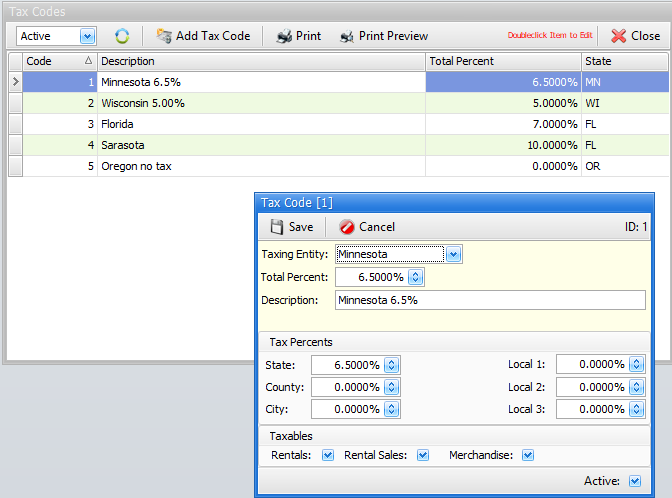

When you enter this program, you will be presented with a list screen of all tax codes currently set up for your operation. You need to enter tax codes for each different tax percentage you take. For example, if you collect 7% sales tax if you deliver to Minneapolis, but you collect 6.5% sales tax at your store in Rochester, you need to set up two tax codes, one for each tax structure.

Please watch this short video on setting up and maintaining tax codes

Start by double clicking on the existing tax code that was installed with FocalPoint and modify it to suit your needs. You may double click on any of the entries in the list to edit or view existing tax codes. To add a new tax code, click on the Add Tax Code button.

Common steps to add a tax code

1.Use the drop-down to select the state that you will be paying tax to.

2.Enter the total tax percentage for this tax code as a decimal. For example, for 6.5% enter .065.

3.A tax code description will fill in for you but you can change the tax code description to suit your needs. This description will be used for tax code reporting.

4.In the Tax Percents table near the bottom of the screen, fill in the fields appropriately that add up to the total tax rate. For example, if the total tax was 6.5 percent, the state tax might be 6% and the county tax might be 5%. Again, enter this field as a decimal (.06 for 6%).

5.Click on [SAVE] to save the tax code or [CANCEL] to cancel your changes. Afterward, press [CLOSE] and repeat the process for additional tax codes.

Definitions of fields and buttons on the screen

Save

Use this button to save your tax code. If the Tax Percents do not add up to the Total Tax %, you will be warned.

Cancel

Use this button to cancel your changes or addition.

Taxing Entity

Choose from the drop down list the state associated with this tax code.

Total Tax %

This field represents the TOTAL tax to be charged to taxable items when this tax code is used.

Tax Code Description

The tax code description is used on printed documents such as contracts and sales invoices.

Tax Percents

These fields represent the "breakdown" of the tax. The percentages entered in this section should add up to the Total Tax %. These breakdowns will be shown on the sales tax report.

Taxables

Choose if this tax code is applicable to rental, rental sales (when you sell a rental item), and mechandise.

Sales Tax Changes

If your state changes sales tax percentages, you have two choices in the tax code file:

•Change the existing sales tax codes. Doing so will change the tax rates on existing orders. It will also change the results of all sales tax reports run prior to your changes. As such, you will want to keep hard copies of your old sales tax reports (B-7-2 from the main menu) for any future tax audit purposes.

•Add new tax codes for the tax codes that have changed. Doing so will not change the tax rates on existing orders. It will not change the results of all sales tax reports run prior to your changes. If you do this you will probably also want to change the descriptions of your old tax codes to start with something like “DO NOT USE” so that you do not accidentally use old tax codes. If you choose this approach, but you still want existing orders tax codes to change, you will need to go into all open orders and change the tax codes manually.

The preferential method is to add new tax codes and leave the old tax codes as is for historical reporting stability. If you add new tax codes:

1.You will want to go into the store manager file and change the store's default tax code. The field in the store manager file is the first field on the first tab.

2.If you have assigned any tax codes to customers, rental items or merchandise items (we advise you don't do this unless some unique circumstances force you to), then you will need to change the tax codes in the affected customer records, rental item records, and merchandise records.