Extracting Financial Data - Cash Basis

A-C from the Main Menu

Contrary to extracting accrual financial data from FocalPoint, the cash basis accounting screen will look at all payments for a day or date range, then dissect each payment and determine how much of each payment was for each posting code. FocalPoint algorithm with dissect based on percentages, so if you collect $1000 on a $2000 open order, FocalPoint will look at the rates (for rental items), selling prices (for merchandise), and tax and damage waiver percentages to calculate how much of the $1000 should be allocated to each posting code. As such, setting up posting codes and assigning posting codes to your items, payment types and other areas of FocalPoint still necessary.

For more information on cash basis vs accrual basis accounting, please contact your accountant. You can also search the internet for terms like "should i use cash or accrual basis" for everybody's opinions on which to choose.

Guidelines

When using the FocalPoint Cash Basis screen, please follow these simple guidelines:

Keep your revenue simple - If all of your rental items are using the "rental revenue" posting code, this will work well. Cash Basis accounting is all about simplicity. As mentioned previously, if you collect $1000 on a $2000 open order, FocalPoint will look at the rates (for rental items), selling prices (for merchandise), and tax and damage waiver percentages to calculate how much of the $1000 should be allocated to each posting code. If you change the items that are on this order, and the new items have different posting codes than the old ones, FocalPoint will NOT move revenue from one posting code to another. When you took the $1000 payment, the revenue was recorded, and it will not change. If you refund money however, FocalPoint will look at the current rental items, and if different items are on the order than originally, with different posting codes, FocalPoint will refund based on revenue for the current posting codes. End result - if you have items with many different posting codes, and you change items on an order that has a payment on it, then close that order for less money than originally collected, you run the risk of recognizing revenue for one GL account, and refunding revenue for a different GL account. If all of your items have a single posting code assigned to them, this risk is eliminated.

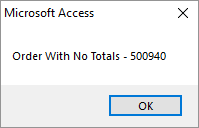

Don't "zero out" line items when an order is voided or cancelled - If your customer cancels an order, or you need to void it for some other reason, simply refund the money and void the order. Do not zero out the line items. If you do, FocalPoint will not know how to reduce the revenue, and you will receive messages like this so that you can make manual journal entries in your accounting software to account for this:

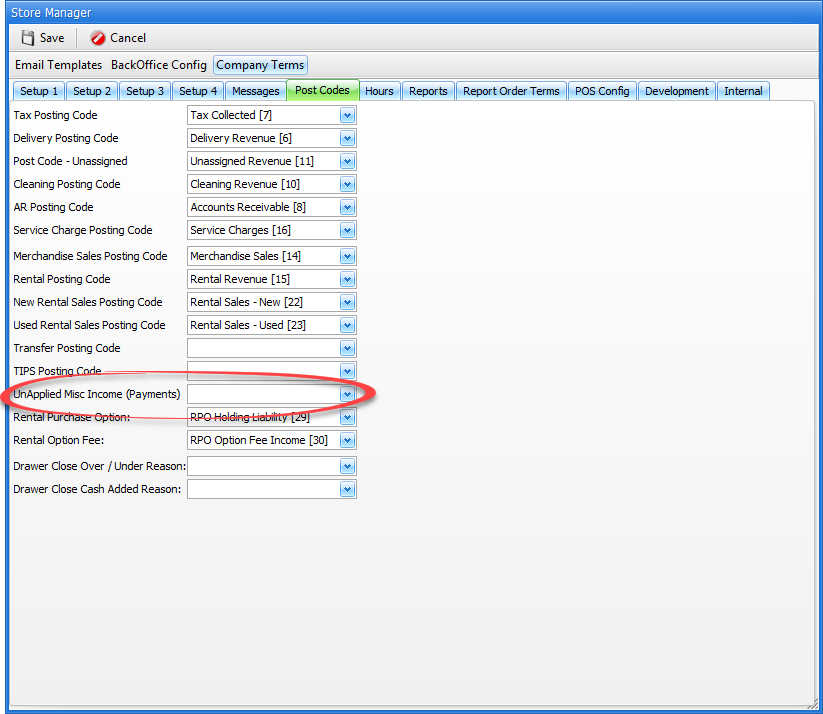

Tell FocalPoint what to do with un-applied A/R payments - If you take a payment on account, and do not apply this payment to any invoices, FocalPoint will not know how to assign revenue. You will need to set up a posting code specifically for this cash basis activity to act as a holding account for this money until it is applied. Then, in the store manager file, C-4 from the main menu, "Post Codes" tab, assign this posting code to the field named "UnApplied Misc Income (Payments), shown below.

Know how to make journal entries in your accounting software when you un-apply payments and re-apply payments in A/R - If you do, you may need to create a journal entry if, for example, you unapplied a payment from an invoice that was only for rental revenue, and then re-applied the payment that was specifically for finance charges, FocalPoint will not re-assign revenue on the cash basis screen. You will need to do a journal entry to re-assign revenue if you need to.

Setup

1.Set up and assign posting codes.The cash basis accounting screens only use posting codes, not the GL Accounts assigned to posting codes. So, you only need to make sure you have posting codes set up and then assign the posting codes to all of the areas necessary in FocalPoint. Follow the links to learn how to do this.

2.Assign a posting code to the Unapplied Misc Income (Payments) field in the store manager file. If you take a payment on account, and do not apply this payment to any invoices, FocalPoint will not know how to assign revenue. You will need to set up a posting code specifically for this cash basis activity to act as a holding account for this money until it is applied. Then, in the store manager file, C-4 from the main menu, "Post Codes" tab, assign this posting code to the field named "UnApplied Misc Income (Payments), shown above.

Using the Cash Basis Accounting screen

You Must be setup in the Store Manager to process on a Cash Basis.

Please contact Visum Support if this is not already enabled (call or email support@visum-corp.com).

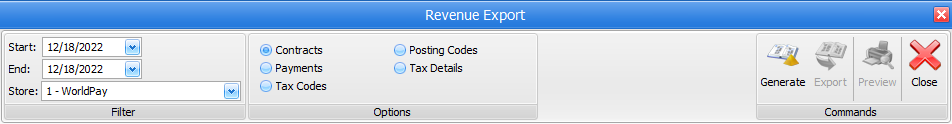

Go to A-2 from the main menu. Once open, enter the dates that you wish to show cash basis data for, select a store, then click Generate.

There are 5 radio buttons on the screen that allow you to see cash basis data. After you select any of them, click on Generate to refresh the screen. You may also click on Export to export results to a spreadsheet view, which can then be exported to Excel.

•Contracts - Shows a list of all contracts that had payments taken (or refunded) for the date range.

•Payments - Shows a list of all payments/refunds for the date range. "FC" is Front Counter, "CR" is Credit, "WO" is Work Order, "MP" is Miscellaneous Payments, which is usually payments on account.

•Tax Codes - Shows a list of all tax codes affected by payments for the date range. Columns show if the payment was for taxable, non-taxable or tax exempt revenue, and also show the municipality breakouts defined in the tax code file.

•Posting Codes - Shows a break out of payments by revenue type, as determined by how y ou set up and assigned your tax codes. This screen would most likely be used to create a journal entry in your accounting software for revenue recognition and sales tax payable.

•Tax Details - Shows taxable, non-taxable and tax exempt amounts for each payment by transaction.