6-5 from the main menu

The purpose of an A/R Credit adjustment is to decrease the A/R balance of a customers account. Typical uses for these types of adjustments are bad debt write offs and waived finance charges. When creating a credit adjustment, you will be prompted for an expense code, which you should have in place prior to starting the credit adjustment. The use of an expense code will in affect help FocalPoint know what the offsetting "debit entry" is for this credit.

You will need to select an expense code when creating an accounts receivable credit adjustment.

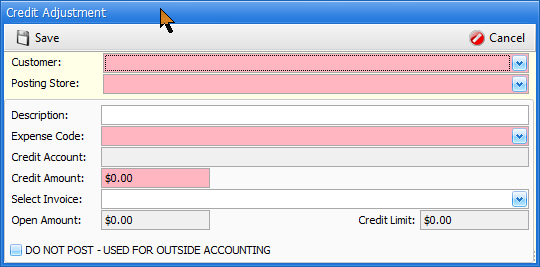

Fields

Customer

Begin typing the name of the customer's account which you want to apply the credit to. Optionally, you may press the Drop Down arrow and scroll through your customer list to select the customer.

Posting Store

Select the store that you are in, or the store from which you would like to export this credit entry when exporting to a third party accounting software package.

Description

Enter a description for this transaction. This description will be retained in the data files and show on reports.

Expense Code

Begin typing the name of the expense code that you want to use for the Debit for this transaction. Typically the account being debited will carry a debit balance, such as an expense account or asset account. When you select the expense code, the GL account that will be debited will fill in below the expense code.

Credit Amount

Enter the amount to Credit.

Select Invoice to Apply Against

Either enter the invoice number, or use the drop down arrow to select all available invoices to apply the credit to for this customer, or choose no invoice to leave the credit unapplied

Upon completion, press SAVE to save the credit, or CANCEL to not save the credit adjustment.