During the creation of an order, you can sell a rental item with a “rental purchase option” (RPO). Here's how:

Initial setup:

In the post codes tab of the store manager file (C-4 from the main menu) there are two fields that will need to be populated with a posting code:

Rental Purchase Option - The main account of the posting code in this field will be an accrual account that is credited each month for the amount of the rental that is to be applied to the eventual sale of the item.

Rental Option Fee - The main account of the posting code in this field will be credited. It's an add on charge, and it's your revenue to keep. The example below illustrates how/why.

Putting it in use:

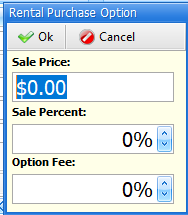

When creating an order, on the order header tab, you will need to enable the RPO check-box. When you do this, a screen will pop up asking you for:

Once you OK this screen, another "Purchase Terms" prompt will appear. Enter the number of months this rental is expected to last in this field, then click OK.

When you add an item to an order, you will be prompted for:

•Sale price - The selling price of the item

•Sale Percent - Percentage of rental fees that will apply to the sale of the item.

•Option Fee - An “Option Fee”, which is an add on percentage amount.

A couple of things worth noting here:

•You can only sell one item on an order using RPO functionality

•If an item is already on an order and you edit the order and enable the RPO check-box, you will immediately be prompted for sale price, sale percent and option fees.

When you print the order, you will see additional Rental Purchase Option information that shows you and your customer

•Purchase Price

•Terms

•Monthly Rate

•XX% to apply: $999

•Adjusted selling price

•X% option fee

•Final RPO Price

The rest of the functionality is explained with an example:

A customer wants to rent an item with an option to purchase. You have agreed that 80% of all rental that they get billed will apply to the sale of the item. They will rent it for 6 months at $1000 per month. Further, you add a 2% option fee to this transaction because you really didn’t want to sell this item, but the customer is pressing you to purchase it, so you want to make a little more profit on it.

You add an item to an order. While doing so, you enable the RPO check-box. The screens that comes up asks you questions, and you answer them as follows:

•Sale price - $10,000.00

•Sale Percent - 80%

•Option Fee - 2%

•Purchase Terms - Number of months - 6

The rental rate of this item is $1000 / month.

As the months go by, you bill the customer $1,000 per month. As you are cycle billing, you are closing orders, so revenue will need to be accounted for. For each $1,000.00 invoice:

•$200.00 will go to rental revenue per the rental posting code associated with the rental item

•$800.00 will go to an accrual account that is designated the posting code assignment in the store manager field "Rental Purchase Option"

•Arguably, this is an oversimplified example. For the sake of further discussion, the tax/damage waiver/environmental fees/etc would still go to the same revenue accounts as before.

If the order is closed by an end user any time before the 7th month or on the 7th month, the end user will be prompted “do you want to sell this item?”. If so, the item is sold on the order. For example, if an end user closes the order after 6 months of billing:

•The item would be changed to “** SOLD **”

•The selling price of the item would be $5,304.00

o$800 per month for 6 months applied to the item, $10,000 - (800*6) = $5,200.

oAdd back 2% ($5,200 * 2% = $104), $5,200 + $104 = $5,304.00

In the financial export for the day you close the order (for this example), you will see a DEBIT $4,800.00 to the main account associated with the Rental Purchase Option posting code in the store manager file, and CREDIT $4,800.00 to the main account associated with the SALES posing code for the rental item. This would be necessary to convert the accrued RPO revenue to sales revenue.

There could be a time where the end user closes the order and chooses NOT to sell the item. In the export for the day the order closes under this scenario, an entry would need to be made to DEBIT $4,800.00 to the main account associated with the RPO posting code for the rental item, and CREDIT $4,800.00 to the main account associated with the RENTAL posing code for the rental item. This would be necessary to convert the accrued RPO revenue to rental revenue.

After 6 months of billing, the order will no longer monthly bill.