6-5 from the main menu

The purpose of an A/R Debit adjustment is to increase the balance of your customer's A/R account balance. In a sense, you are creating an invoice for the customer without using any order entry processes. This functionality is also useful for creating a debit entry that you can use to offset credits on a customers account that either should not exist.

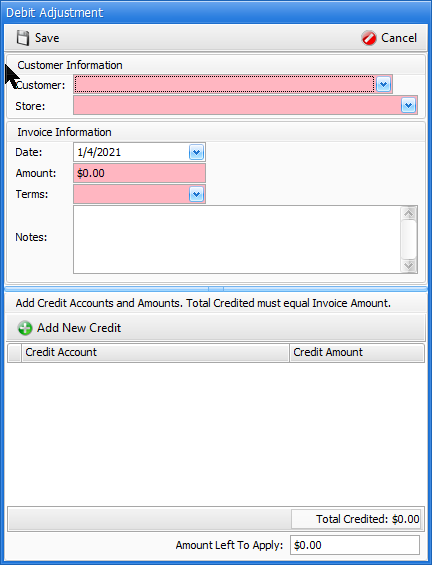

Customer

Begin typing the name of the customer's account which you want to apply the credit to or click on the drop-down arrow and scroll through your customer list to select the customer.

Store #

Select the appropriate company number related to this debit adjustment.

Invoice Number

An invoice number will default for you.

Invoice Date

The invoice date will default to today, which should also be left to its defaulted value whenever possible. Regardless of the date entered, for accounting purposes the debit adjustment will post (export to a file for use in other accounting software) as of the date it was entered.

Invoice Amount

Enter the amount of the invoice.

Terms

Terms may be giving to this invoice (debit adjustment) being made. The terms assigned will determine the due date of the invoice.

***NOTE***

For the Credit Account and Credit Amount fields shown below, more than one credit account / amount can be selected for the debit adjustment. For example, if you are creating a $100 Debit adjustment, you can allocate $90 to rental revenue and $10 to damage waiver revenue.

Add New Credit

When you click on Add New Credit, you will be able to select a GL account and an amount to allocate to the GL account. Add as many new credit entries as needed to add up to the debit adjustment amount above.

Press Save upon completion of crediting the debit adjustment, Cancel to abandon the process.