Terms Codes

6-9-6 from the main menu

Objective:

Set up a terms code for each different type of terms you offer. Yes, "no terms" is a type of terms, normally called "due on receipt" or "COD"

Terms codes are assigned to customers, and affect due dates of invoices, as well as applicable service charges when creating service charge invoices. The most important function of a terms code in FocalPoint is determine when unpaid invoices become due and when these invoices become eligible for finance charges. You may set up two terms codes, one named "Due in 30 days" and one named "50% down, Net Due in 30 Days", but in the end, both terms codes will set an invoice due date to 30 days after the invoice date.

Another purpose of the terms code is to accurately describe the terms that the customer is offered. The description of the terms code will print on orders (reservations, contracts, etc).

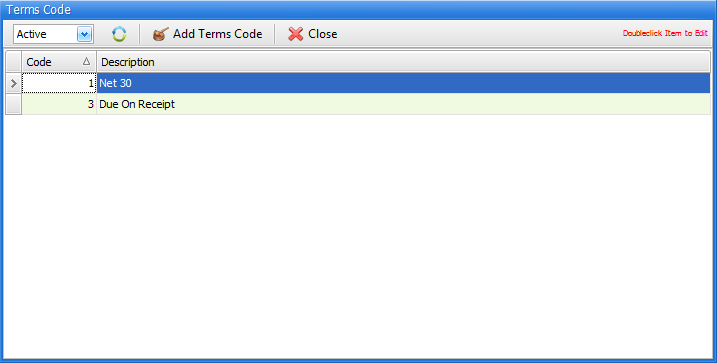

Two terms codes will be set up for you which you are free to change to fit your needs by double clicking on the code in the list. If you need to add additional terms codes, click on Add Terms Code .

Use the Active/De-Active/All drop down field to choose to see "active", "de-activated" or "all" terms codes. If you choose "All", the far-right "Active" column in the list of Terms Codes will be visible, otherwise this "Active" column will not be visible.

How does all of this work?

First, you need to set a field in the store manager file, C-4 from the main menu, Setup 4 tab, named "Invoice Date as Return Date (Else Use Process Date). If this field is checked, the invoice date will be set to the return date you entered when returning an order. If this field is not checked, the invoice date will be set to the day you actually close the order. If you close orders promptly (on the same day items are returned), then you should not notice any difference whether this check box is checked or not. However, if you are doing a return for an order that was returned 20 days ago, this flag will either set the invoice date to 20 days ago, or it will set it to "today".

Net days VS Start Day - What's the difference.

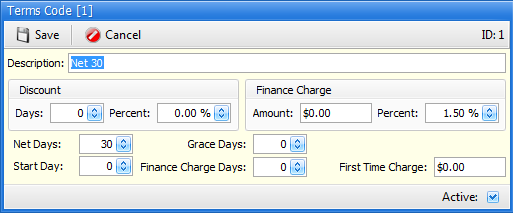

Net Days

If you set the Net Days on a terms code, the Start Day and Grace Day will be unavailable. With Net Days, you are setting an invoice due date based on a number of days from the date it is created. For example, if the invoice date is 11/19 and your "Net Days" are 30, the due date of this invoice will be 12/19.

Start Day and Grace Days

If you set the Start Day on a terms code, the Net Days field will be unavailable. With Start Day, you decide on which day of the month an invoice is due. For example, if you set your Start Day to 10, then any invoice you create will be due on the next 10th day of a month.

The Grace Days field is used in conjunction with the Start Day field. For example, let's say you created an invoice on 11/03. If your Start Day is "10", the invoice will be due on 11/10, which gives your customer 7 days to pay. However, if you set your Grace Days to "10", you will effectively give you customer another month to pay. So, any invoices created on 10/10 - 10/31 will be due on 11/10, but any invoices created between 11/01 and 11/09 will not be due until 12/10.

Finance Charge Days

This field allows you to control WHEN an invoice will be eligible for finance charges, and works differently depending on whether you take the "Net Days" approach or the "Start Day" approach.

Let’s say you set your Net Days to 30 and your Finance Charge Days to 55. Your terms are that the invoice is due in 30 days from the invoice day but the invoice will not be eligible for finance charges until 55 days after the invoice date.

Alternatively, let’s say you set your Start Day to 10 and your Finance Charge Days to 30. Now, your terms are that the invoice is due on the 10th of the month, and the invoice will not be eligible for finance charges until 30 days after the DUE Date (not the invoice date as is the case with Net Days).

First Time Charge

If this field is set to something other than $0.00, then the first time an invoice is assessed a finance charge, the amount in this field will be assessed instead of whatever would normally be calculated based on the Finance Charge Amount or Finance Charge Percent fields.